The type of loan you’re trying to get — whether it is car, house or personalized — will figure out the amount you might want to borrow.

Made to support users make self-assured conclusions on the web, this Web page consists of information about a wide range of services. Particular details, which includes but not restricted to rates and Particular gives, are provided to us straight from our partners and therefore are dynamic and issue to alter Anytime with no prior notice.

Inside the unlucky celebration that the business goes bankrupt and you'll't repay your loan, You may additionally eliminate individual property.

Just after obtaining a disbursement of funds from a line of credit score you might begin to receive a regular invoice for making repayments. Based on your cycle day this may be as early as 21 times from disbursement or provided that 51 days soon after disbursement.

With any type of financing, it’s very easy to slide into a cycle of financial debt, specifically with fewer common forms of funding, like MCAs and Bill factoring.

Applications are processed and facilitated because of the borrower’s CDC with forty% of funding coming from that entity and backed because of the SBA. The remaining 50% of your loan quantity emanates from A non-public sector bank or credit score union, and borrowers are to blame for a ten% deposit.

For the duration of the application procedure, you may need to post documentation, like your business prepare, economic statements, bank statements and tax returns. There's also a good probability that your individual credit score rating will be pulled, so a lender can gauge your creditworthiness.

Loan restrictions. Some lenders only provide small loan amounts. If you want a larger loan, you’ll desire to prioritize lenders that could supply extra considerable loan amounts.

Lenders concentrate on your individual credit score rating when environment least credit rating rating needs, nonetheless, they may also Check out your business credit score rating. But lenders Will not state any prerequisites for business credit rating scores.

Our top business dollars advance, generally known as (merchant hard cash progress) has helped Countless businesses acquire funding, making it possible for them to deploy it towards any dilemma or challenge. By incorporating modern day program into our software procedure, we’re in a position to Minimize down time it will require to obtain funding to only minutes and hrs.

“And I believed, why am I continuing to pay for hire when I could own my own constructing? I could have a constructing that may begin appreciating and creating dollars, And that i would've Charge of my very own House.”

Loans are geared toward borrowers who're unbanked and also have hassle qualifying for economical products and solutions

Getting to be a franchisee will help you achieve your intention of business ownership more rapidly and a lot easier than ranging from the bottom up, however you will 504 SBA loan Reno nevertheless require cash.

Demands fluctuate by lender, but businesses generally qualify for business loans dependant on dimensions, earnings, personal and business credit profiles, and how much time they’ve been working. They acquire funding as lump sums or credit score strains, according to the sort of loan and lender.

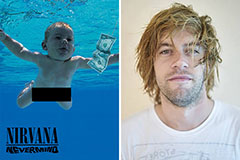

Spencer Elden Then & Now!

Spencer Elden Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Kane Then & Now!

Kane Then & Now!